pa estate tax exemption 2020

FORM TO THE PA DEPARTMENT OF REVENUE. If you own your primary residence you are eligible for the Homestead Exemption on your Real Estate Tax.

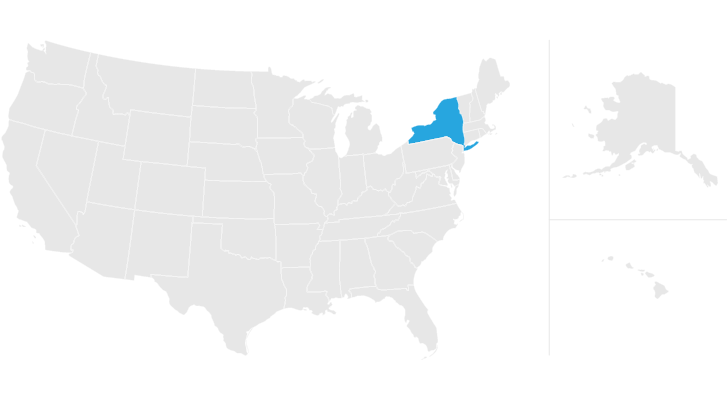

States With No Estate Tax Or Inheritance Tax Plan Where You Die

REV-714 -- Register of Wills Monthly Report.

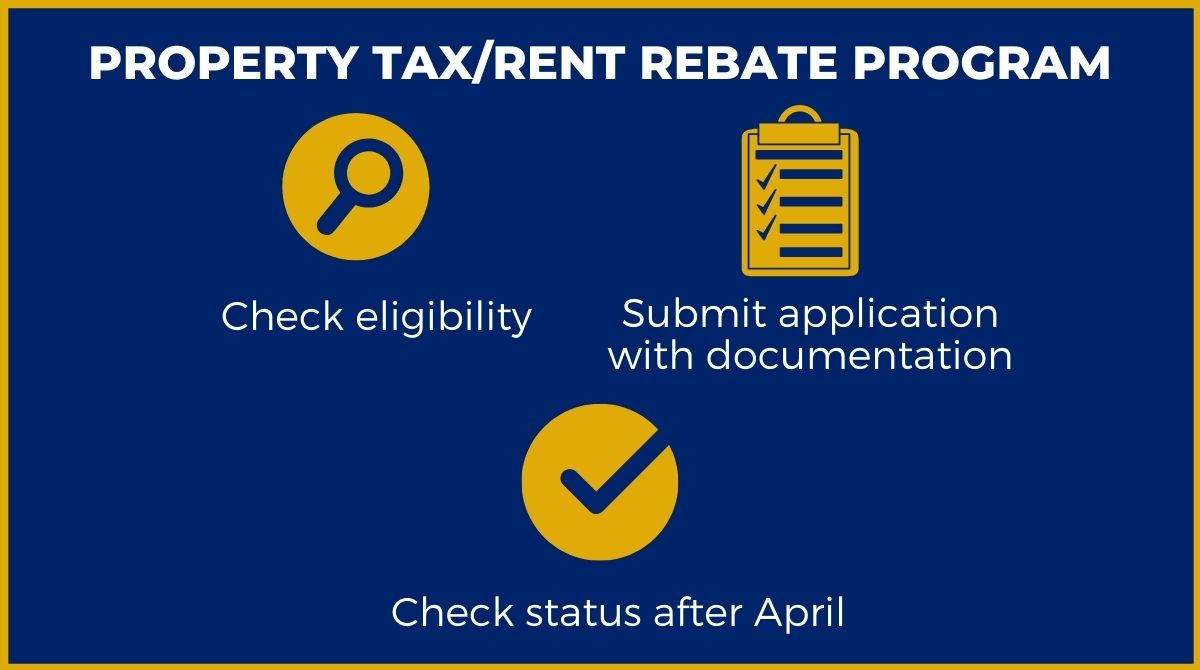

. Veteran must prove financial need according to the criteria established by the State Veterans Commission if their annual income exceeds 95279 effective Jan. This means that a. Pennsylvanians who are approved for a rebate on property taxes or rent paid in 2021 will.

REV-1197 -- Schedule AU. The Homestead Exemption reduces the taxable portion of your propertys. The estate tax exemption for 2020 is 1158 million an increase from 114 million in 2019.

PURPOSE OF FORM The fiduciary of a resident estate or trust uses the PA-41 Fiduciary Income Tax Return. This form may be used in conjunction with form REV-1715 Exempt Organization Declaration of Sales Tax. Ad PA ABLE provides benefits for PA residents unavailable from other states ABLE accounts.

Must prove financial need. The tax rate varies. Ad Download or Email PA REV-1737-1 More Fillable Forms Register and Subscribe Now.

Generally there is no tax on what you leave to your spouse or charity. REV-720 -- Inheritance Tax General Information. Early filers should apply by September 13 2020.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. 11400000 in 2019 11580000 in 2020 11700000 in 2021 and 12060000 in 2022.

And there is no tax on the first 1158 million in 2020 that passes to your other heirs. An Act amending Title 51 Military Affairs of the Pennsylvania Consolidated Statutes in disabled veterans real estate tax exemption further providing for duty of. Learn how to deduct your PA ABLE contributions on PA income taxes.

Learn how to deduct your PA ABLE contributions on PA income taxes. One-Time Bonus Rebates for 2021 Claimants of Property TaxRent Rebate Program. PA-41 Fiduciary Income Tax Return for an estate or trust with a foreign address.

45 for any asset transfers to lineal heirs or direct descendants. Homestead Exemption for all Philadelphia homeowners who. Must prove financial need.

Get information on how the estate tax may apply to your taxable estate at your death. Ad Verified Tax Professionals Answer All Your Questions in 1-on-1 Online Chat. They are required to report and pay tax on the income from.

Philadelphia PA 19115 REAL ESTATE TAX RELIEF HOMESTEAD Final Deadline to apply for the Homestead Exemption is December 1 2020. Estates and trusts are taxpayers for Pennsylvania personal income tax purposes. The City offers a number of abatement and exemption programs for Real Estate Taxes.

Ad PA ABLE provides benefits for PA residents unavailable from other states ABLE accounts. About 4100 estate tax returns were filed for people who died in 2020 of which only about 1900 estates were taxable less than 01 percent of the 28 million people. 15 for asset transfers to other heirs.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Ad Download Or Email REV-1220 AS More Fillable Forms Register and Subscribe Now. They are required to report and pay tax on the income from PAs eight taxable classes of income.

12 for asset transfers to siblings. Pennsylvania Inheritance Tax Safe Deposit Boxes. The tax rate is.

Pennsylvania Estate Tax Everything You Need To Know Smartasset

New York Estate Tax Everything You Need To Know Smartasset

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

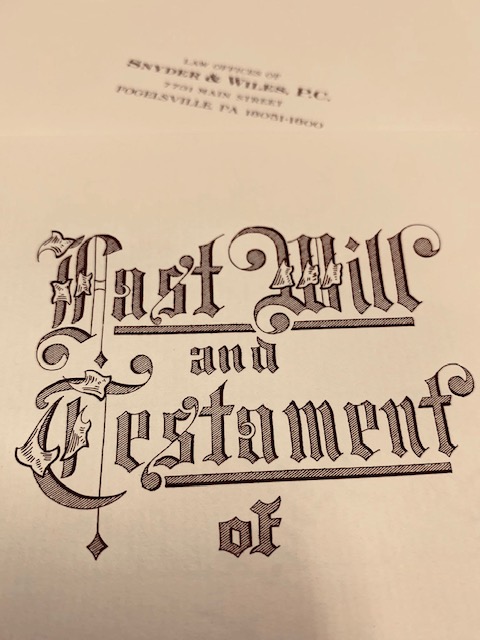

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Here Are The 2020 Estate Tax Rates The Motley Fool

2020 Estate And Gift Taxes Offit Kurman

Philadelphia Estate Planning Tax Probate Attorney Law Practice Limited To Business Corporation Law Tax Probate Estate Administration Wills Trusts Estate And Trust Tax Return Preparation

Pennsylvania Estate Tax Everything You Need To Know Smartasset

How Long Can The Irs Pursue The Estate Of Someone Who Is Deceased

How Do State Estate And Inheritance Taxes Work Tax Policy Center

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Pennsylvania Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Minimize Or Avoid Pennsylvania Inheritance Tax Retirement Planning

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

State Taxes On Inherited Wealth Center On Budget And Policy Priorities